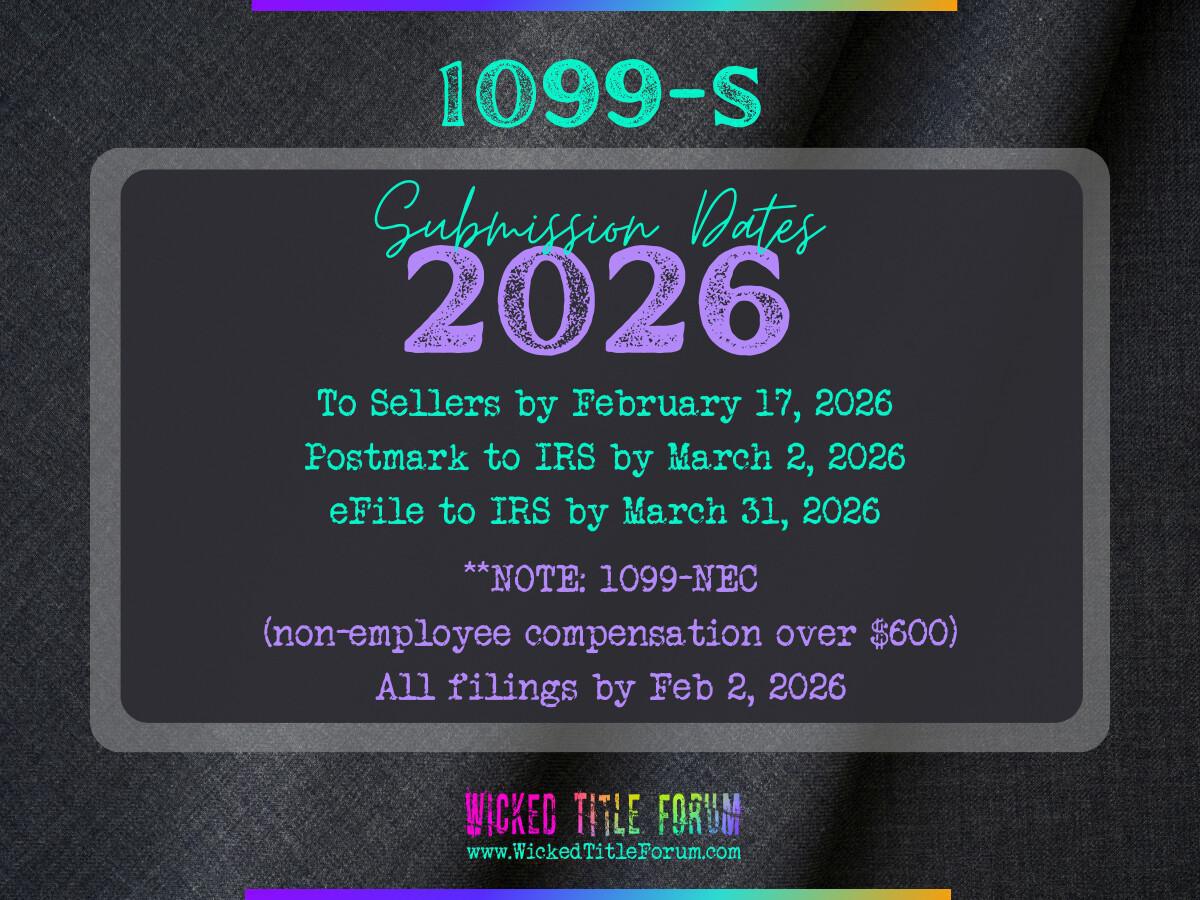

These deadlines are for reporting real estate transactions made during the 2025 tax year:

- February 17, 2026: Furnish Copy B of Form 1099-S to sellers (recipients).

- March 2, 2026: Paper filing deadline with the IRS (if filing fewer than 10 total information returns).

- March 31, 2026: Electronic filing (e-filing) deadline with the IRS. E-filing is mandatory if filing 10 or more information returns in aggregate.